With applied AI, real-time monitoring, and no-code workflows, Sinky Portfolio Monitoring transforms data into alerts, alerts into actions, and actions into decisions that prevent losses and enhance your strategy.

The ideal limit is not calculated. It is predicted.

Automatic limit adjustments based on financial behavior, payment capacity, and each client's risk profile. Sinky's AI identifies patterns, predicts balances, and dynamically optimizes limits, improving retention securely while maximizing returns without allowing for defaults.

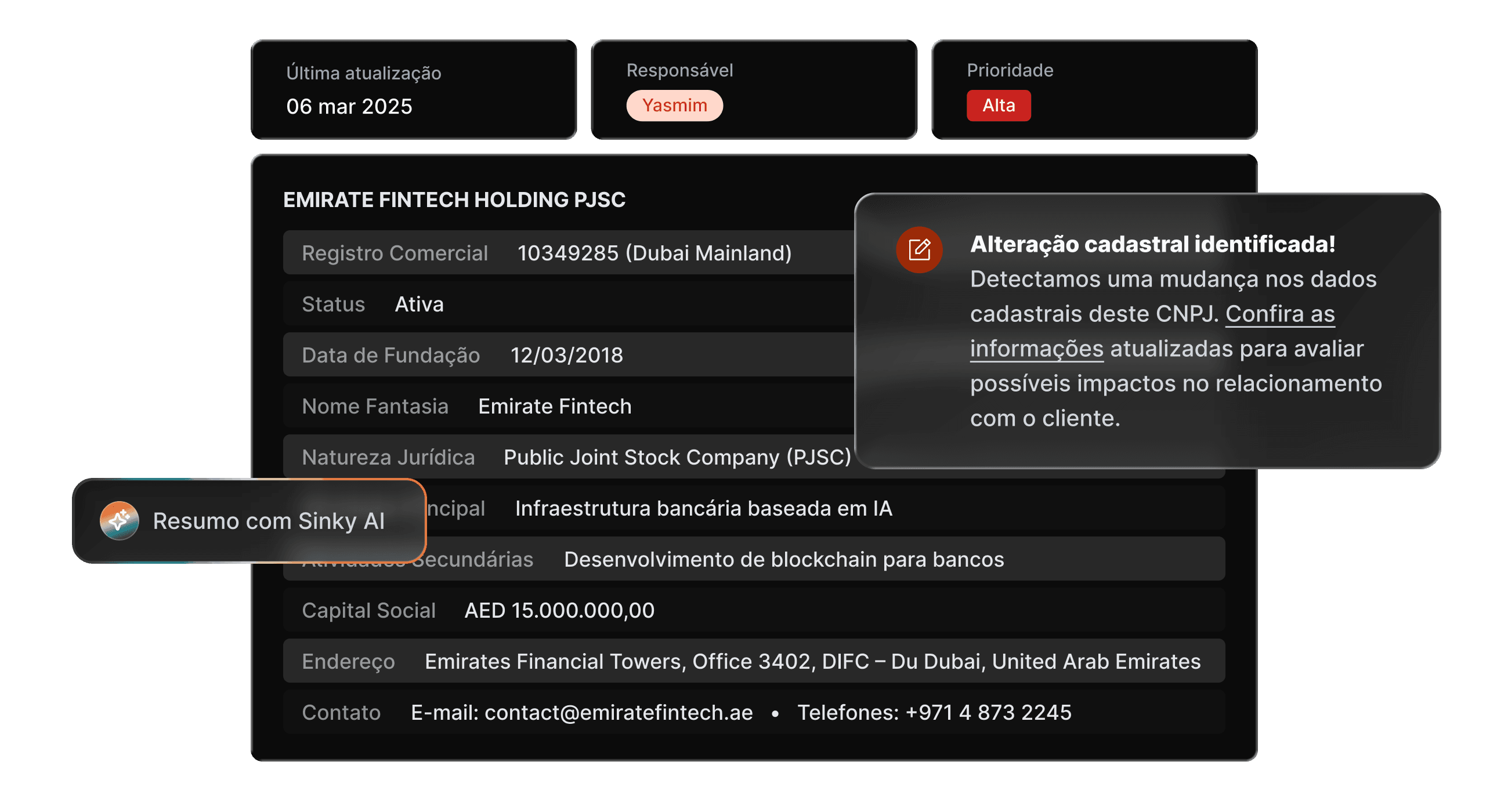

With Sinky's AI, your portfolio is monitored in real-time; credit behavior, suspicious movements, and abrupt changes do not go unnoticed. Everything is tracked, analyzed, and transformed into actionable alerts, so your team has control before a risk turns into a loss.

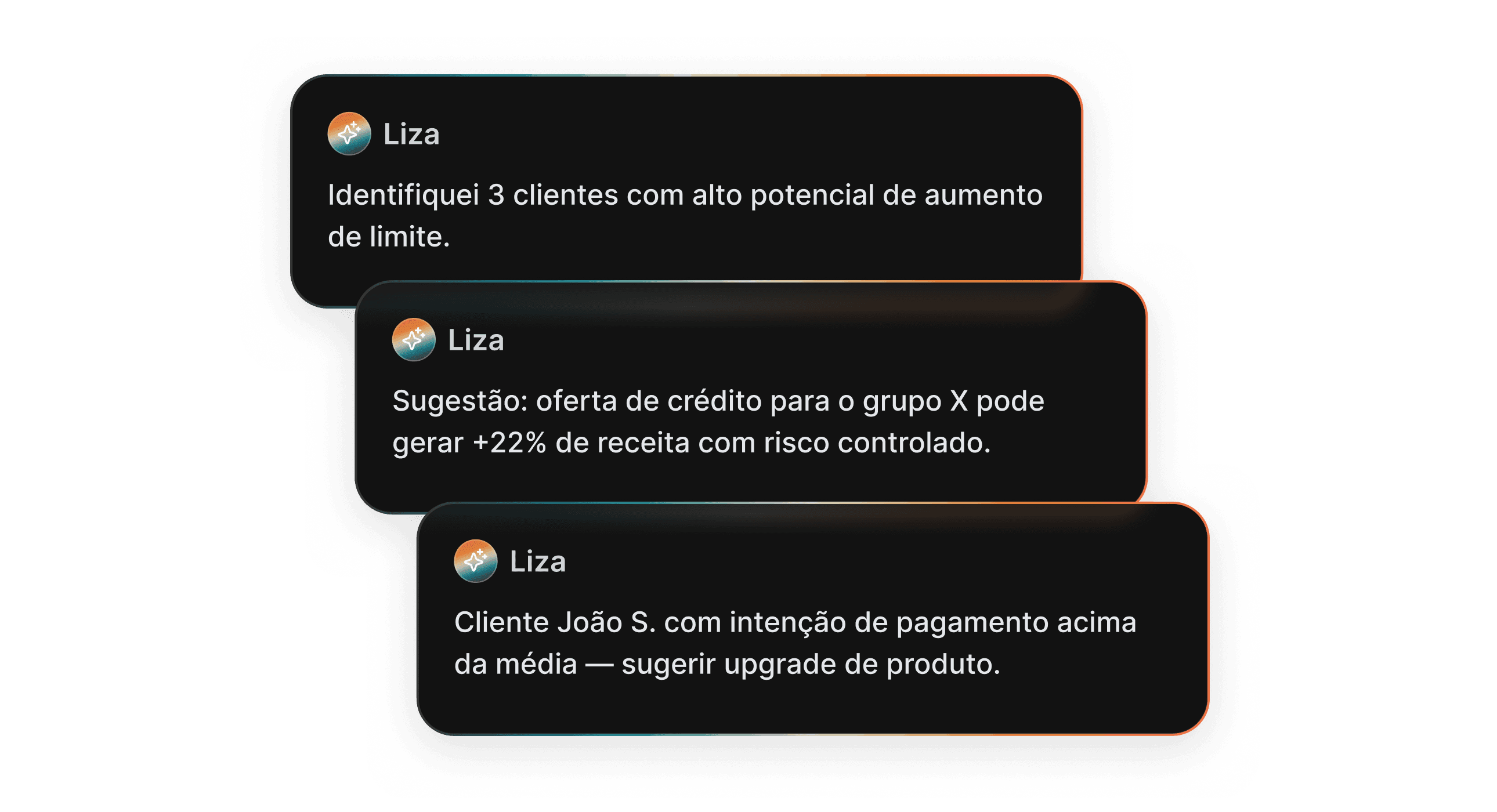

Sinky's AI identifies the best customers to receive additional offers based on payment intent, consumption behavior, and financial power. Automate upsell and cross-sell campaigns with security, intelligence, and high conversion potential.

With predictive models and proactive alerts, Sinky detects at-risk accounts even before the delay occurs. The platform recommends actions such as renegotiation or due date adjustments — all to preserve your cash flow and protect your operation.

Features that not only monitor your portfolio but also transform your operation with applied intelligence, faster decisions, and tangible results.